Creating and having staff adhere to set policies helps establish guidelines for completing tasks by setting parameters that can be useful for business operations.

That’s why creating and maintaining a consistent accounts payable policy is so important to your business.

Setting accounts payable policies can help ensure that consistent policies are used across the board.

A comprehensive accounts payable manual can also serve as a training document for new employees and can easily answer routine questions staff may have throughout the AP process.

An accounts payable policy is the guidelines that are put into place to ensure that AP processing is completed on time and accurately.

Accounts payable policy looks at all aspects of your current AP system and creates a policy around those procedures.

For example, an AP policy may state that all invoices need to be approved by two employees or that invoice discrepancies need to be handled by a specific designee.

The primary function of the AP department is to review, manage, and pay for goods and services received from vendors and suppliers in a timely manner.

But the accounts payable department is also responsible for finding new vendors and suppliers, vetting them, and maintaining a good business relationship with them.

Accounts payable is also responsible for providing accounting with all necessary AP reports.

Finally, the account payable department is responsible for ensuring that all original invoices match purchase orders and shipping receipts.

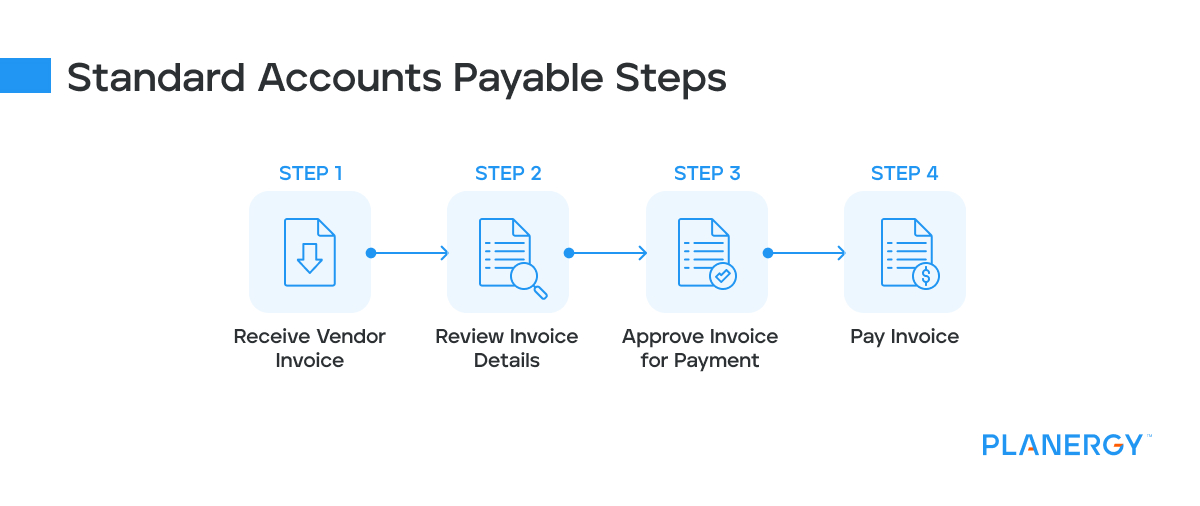

The typical basic accounts payable process consists of four steps:

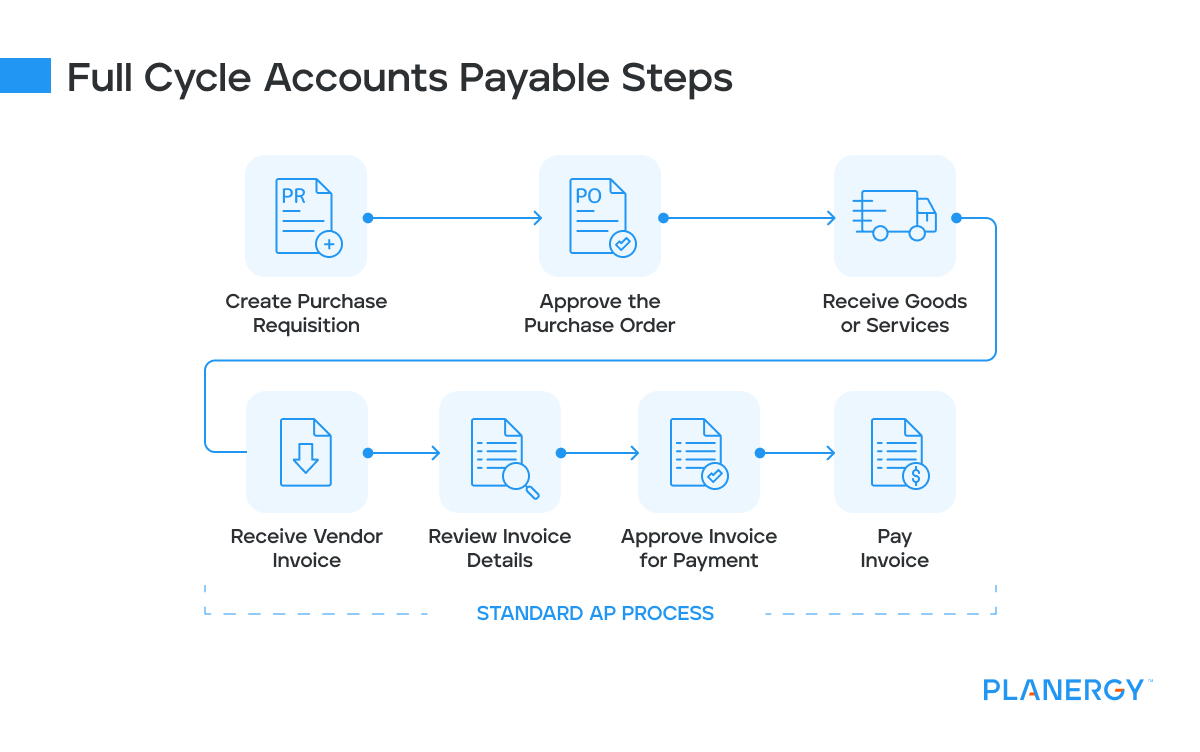

If you’re using a procurement system, you’ll also want to include steps used in the procurement process as well, covering full cycle accounts payable.

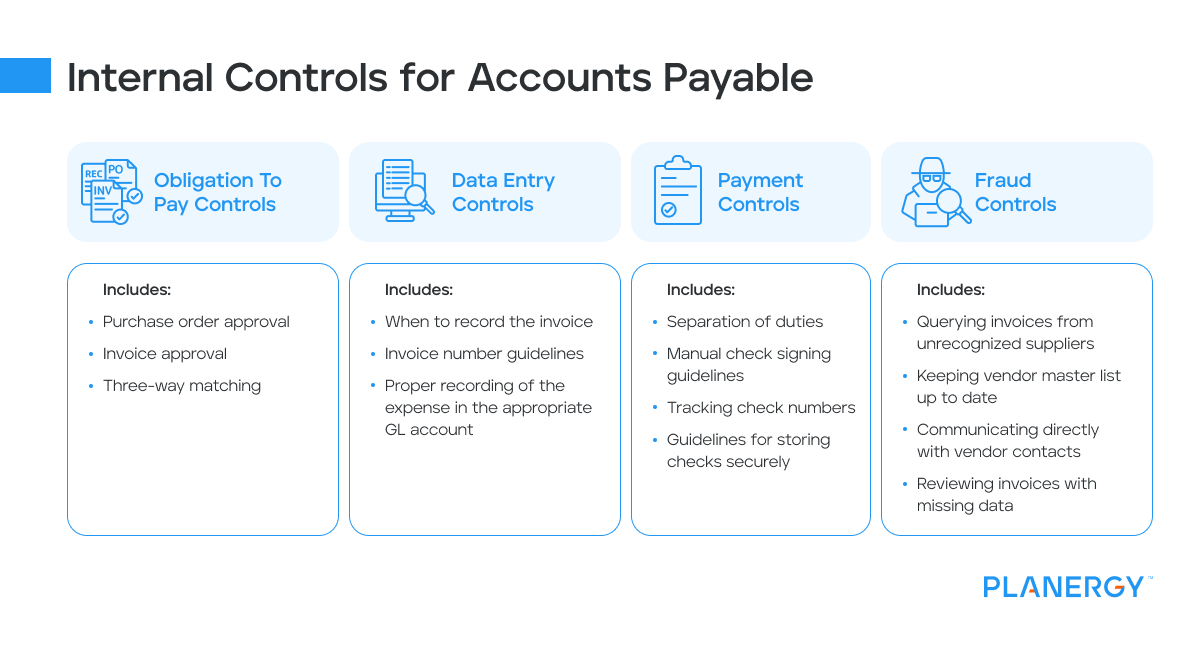

Internal controls are important in AP, as they help to reduce fraud while streamlining the entire AP process.

Establishing internal controls will also increase accuracy, minimize risk, and keep staff members accountable for their actions.

Creating a policy for writing off accounts payable is important, as the International Financial Reporting Standards, or IFRS-9, lists two conditions when accounts payable may be written off.

Write-offs are usually done at the end of the fiscal year.

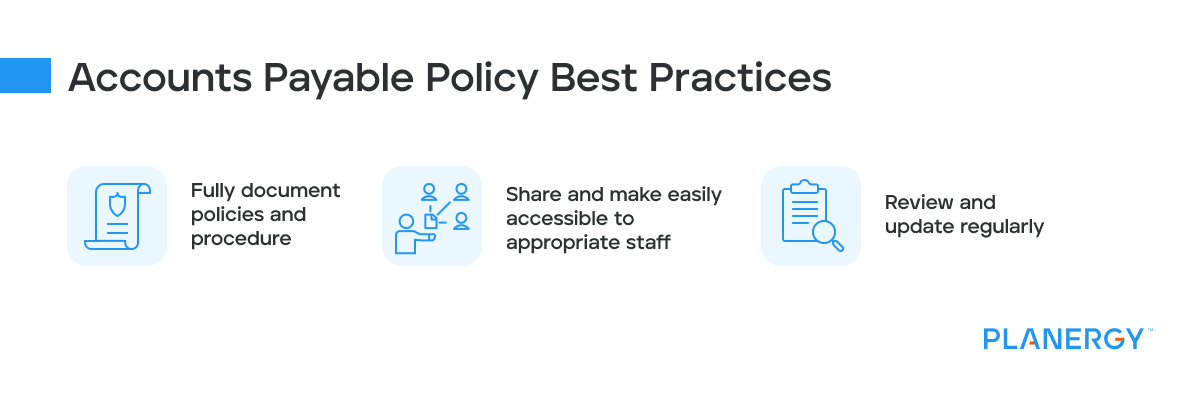

When creating an accounts payable policy and procedures manual for your business, there are several best practices that you should follow.

When creating a policy manual, it’s important that the manual reflects the actual accounts payable process used in your business, including step-by-step instructions and screenshots, when appropriate.

It’s always better to make the manual too detailed rather than not detailed enough.

Starting from scratch with a policy can be a daunting task.

Often it is easier to work from an existing template and edit it to suit your own business.

It can then be improved and updated over time.

The Macomb Township Accounts Payable Policy and Procedure document is a good example of what a completed policy may look like for smaller businesses.

Larger businesses may be better served by creating a larger document using a template like this one from the State of Victoria in Australia, which provides a general structure for a manual, allowing you to delete the areas that don’t apply to your business.

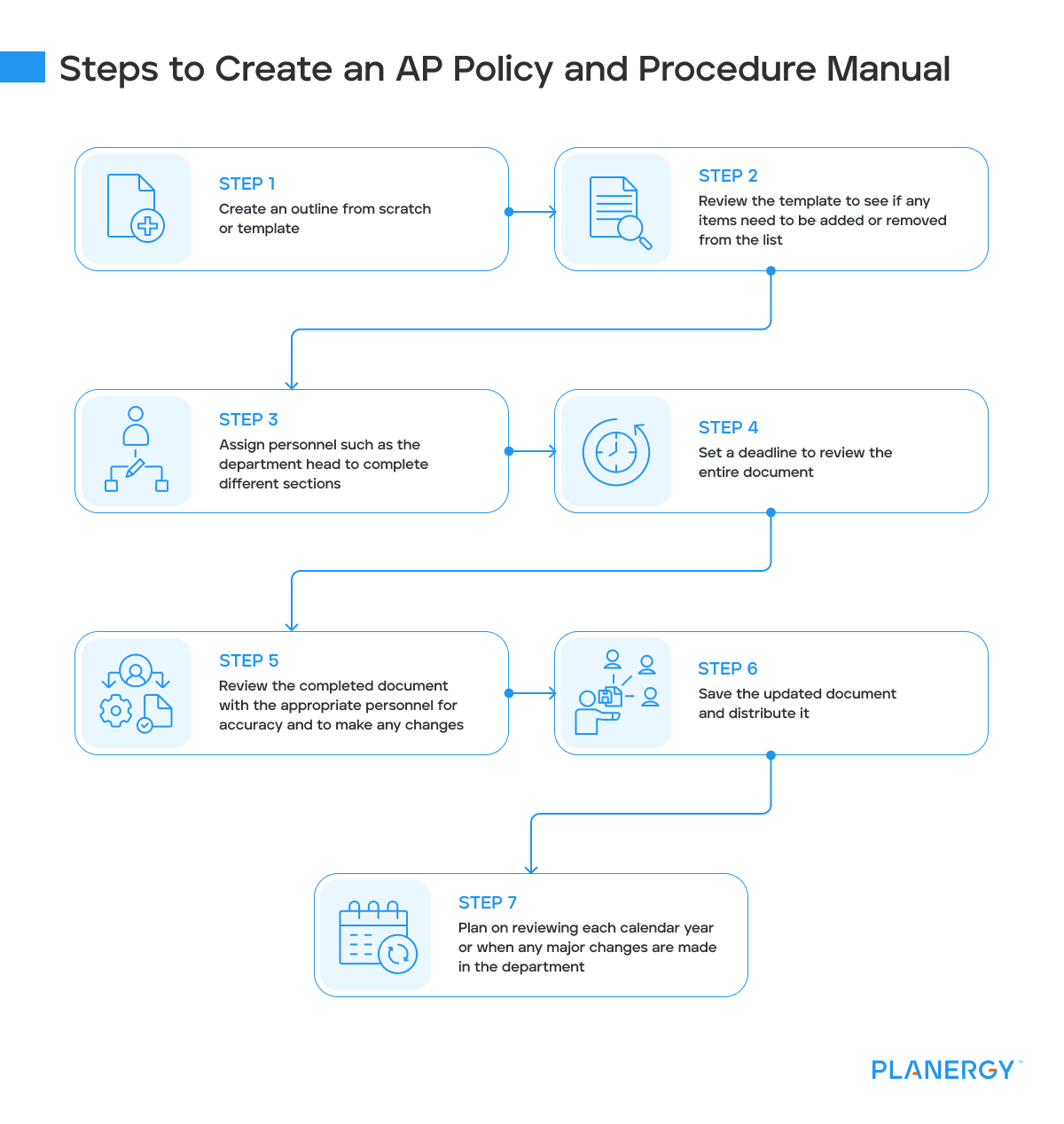

If the thought of creating a manual is overwhelming, following these steps can help guide you through the entire process from initial creation to distribution.

Mail (postal, email, and fax)

Credit card payments

Chart of Accounts

Month end Accruals

Vouchers/ Check request forms

Handling Lost checks

Master Vendor Policy

Dealing with Customer Inquiries

Collecting Vendor Taxpayer Number Information

Travel expenses and travel reimbursements

Policy and Procedures Manual

Businesses can easily add or eliminate areas that do not apply to their business when creating the manual.

Whether you’re creating a manual from scratch or using a template, there are some topics that you’ll want to include in your AP Policy Manual.

These topics include the following: